News

Megan Fox Thumbs: A Digital Phenomenon

Introduction

In the realm of celebrity culture, where every detail is scrutinized and dissected, Megan Fox thumbs have emerged as an unexpected and fascinating subject of intrigue. What began as a casual observation has evolved into a full-fledged digital phenomenon, sparking discussions, fan theories, and even medical inquiries. This article delves into the curious case of Megan Fox thumbs, exploring the reasons behind their viral appeal, the cultural implications, and the broader societal trends they reflect.

The Thumbs that Captivated the World

Megan Fox’s thumbs first gained widespread attention when fans noticed their unique appearance. Shorter than average and slightly clubbed, they deviated from the typical finger proportions. This seemingly minor physical feature sparked a wave of online curiosity, leading to countless memes, fan art, and discussions on social media platforms. The unusual appearance of her thumbs quickly became a defining characteristic, adding an unexpected layer to her already iconic image.

The Psychology of Thumbs

The fascination with Megan Fox thumbs can be attributed to several psychological factors. First, they represent a departure from the societal norm, which often equates beauty with symmetry and perfection. By embracing her unique physical trait, Fox challenges traditional beauty standards and inspires others to celebrate their individuality. Additionally, the thumbs serve as a point of differentiation, setting Fox apart from her peers and making her more memorable.

The Digital Age and Viral Culture

The rise of social media has played a crucial role in amplifying the popularity of Megan Fox’s thumbs. In the digital age, viral content can spread rapidly, reaching millions of people in a matter of hours. The accessibility of information and the power of online communities have allowed fans to share and discuss their observations about Fox’s thumbs, turning them into a trending topic.

Cultural Implications and Body Image

The Megan Fox thumbs phenomenon also sheds light on broader cultural trends related to body image and self-acceptance. In a society that often places unrealistic expectations on physical appearance, Fox’s embrace of her unique features serves as a powerful message of self-love and body positivity. By normalizing imperfections and celebrating diversity, she contributes to a more inclusive and accepting culture.

Medical Perspectives and Brachydactyly

While the exact cause of Megan Fox’s thumb shape remains unknown, it is possible that she has a condition called brachydactyly. Brachydactyly is a genetic disorder characterized by abnormally short fingers or toes. While it is not a serious health condition, it can affect a person’s appearance and self-esteem. The popularity of Megan Fox’s thumbs has helped to raise awareness of brachydactyly and dispel misconceptions about the condition.

Conclusion

Megan Fox thumbs have become more than just a physical feature; they represent a cultural phenomenon that reflects the power of social media, the psychology of celebrity worship, and broader societal trends related to body image and self-acceptance. By embracing her unique appearance, Fox has inspired countless individuals to celebrate their own individuality and challenge traditional beauty standards. As the digital age continues to evolve, it is likely that Megan Fox thumbs will remain a fascinating subject of discussion and a symbol of self-love and acceptance.

News

Taiwan Collaborates with UK to Promote Wellness through ‘Go Healthy with Taiwan 2025’

London, United Kingdom – July 9, 2025 – Taiwan has taken a bold step in driving regional wellness innovation with the launch of the ‘2025 Go Healthy with Taiwan’ campaign in the United Kingdom. Spearheaded by the Taiwan International Trade Administration (TITA) under the Ministry of Economic Affairs and executed by the Taiwan External Trade Development Council (TAITRA), this campaign encourages UK-based public institutions, enterprises, and SMEs to propose pioneering ways to apply Taiwan’s health-focused technologies to local community needs.

The campaign is structured as an open call for proposals across three strategic sectors: Fitness & Sports Technology, Cycling, and Smart Healthcare. Participants will vie for three US$30,000 cash prizes, awarded to the most impactful and innovative proposals. In addition, the top six teams will be invited to Taiwan for an exclusive “Go Healthy Tour”, – a curated, immersive experience offering direct access to Taiwan’s dynamic health technology ecosystem. This tour will feature hands-on demonstrations, site visits, and networking opportunities with leading Taiwanese companies, enabling participants to explore collaboration, product integration, and market expansion opportunities firsthand.

The response in the UK has been extraordinary,” said Mr. Ares Chen (Chen Chien Ming), Director of TAITRA London. “Through this campaign, we are fostering deep, cross-border collaboration that empowers British communities with Taiwan’s most innovative wellness solutions, setting a new benchmark for healthier societies in Asia.”

Sectoral Focus Areas:

Fitness & Sports Technology: From AI-enabled training systems to connected workout equipment, Taiwan’s smart fitness innovations are designed to boost personal and population-wide wellness outcomes.

Cycling: As a global manufacturing hub for high-performance bicycles and a leader in urban cycling infrastructure, Taiwan champions cycling as a sustainable, health-positive mode of transport.

Smart Healthcare: Taiwan’s Medtech sector offers advanced diagnostic platforms, telemedicine capabilities, and wearable technologies that are reshaping healthcare delivery and preventive care models.

Participation is made simple through the SurveyCake platform, which is designed for ease of submission. Detailed guidelines and case examples, such as Acer’s wearable health monitors already adopted by leading hospitals worldwide, are available on the official campaign website to support proposal development.

Proposal Deadline: August 14, 2025

Campaign Website: https://gohealthy.taiwanexcellence.org/

Join Taiwan in creating a healthier, more resilient future through innovation, collaboration, and shared purpose.

About Organisers

The International Trade Administration (TITA), established by Taiwan’s Ministry of Economic Affairs, is tasked with developing trade policies, engaging in international cooperation, and promoting economic agreements. Responsibilities include removing trade barriers, conducting data analysis, administering import-export operations, and resolving trade disputes. The Administration’s comprehensive role spans trade promotion, MICE industry development, and managing commodity classification. It conducts investigations on import relief and anti-dumping cases, addressing diverse facets of international trade, making it a pivotal entity in Taiwan’s global economic engagement. https://www.trade.gov.tw/English/

Taiwan External Trade Development Council (TAITRA) is the leading non-profit, semi-governmental trade promotion organisation in Taiwan. It was founded in 1970 to promote foreign trade, and is jointly sponsored by the government, industry associations, and several commercial organisations. The organisation has a well-coordinated trade promotion and information network, which consists of over 1,200 trained specialists stationed throughout its Taipei headquarters and 60 branches worldwide. In conjunction with its sister organisations, the Taiwan Trade Centre (TTC) and Taipei World Trade Centre (TWTC), TAITRA has created a wealth of trade opportunities through effective promotion strategies. Please visit: www.taitra.org.tw

News

The U.S. Election Heats Up: How Will Global Asset Trends Change with Market Pricing for a Trump Victory?

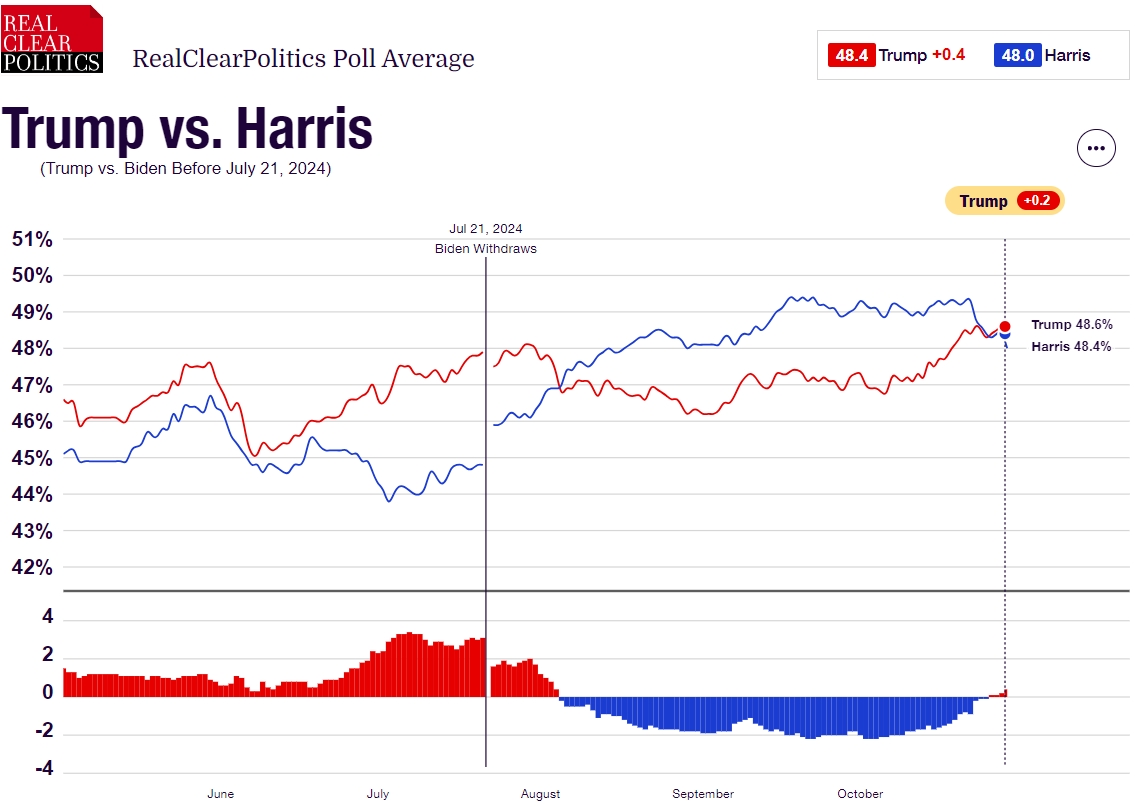

Since October, Trump has surged in the polls, leading to a rapid shift in global market sentiment. Trading strategies are gradually switching to bets on the election outcome. As the U.S. election enters its final showdown phase, the market seems to be picking up increasingly clear signals, with “smart money” significantly pricing in a tilt towards Trump.

The market is placing real bets on a Trump victory.

On Tuesday, shares of the well-known “Trump-related stock,” Trump Media Group, surged another 8.76% following a 21.59% increase on Monday, bringing the total rise since October to 220.54%. Additionally, the KBW Regional Banking Index has risen by 10% over the past month, significantly outpacing the broader market, reflecting the market’s strong confidence in Trump-related assets.

The U.S. dollar and Treasury yields are also showing signs of the “Trump trade.” Currently, the dollar index has surged to the 104-105 range, rising for the fourth consecutive week, putting pressure on non-U.S. currencies. The yield on the 10-year U.S. Treasury has rebounded from previous lows to 4.24%, an increase of 48 basis points since the end of September.

Meanwhile, Bitcoin has become one of the core assets of the “Trump trade” due to Trump’s support for cryptocurrencies. On October 30, Bitcoin broke through the $73,000 mark for the first time in seven months, just 0.2% away from its all-time high. Data shows that since October, U.S. Bitcoin spot ETFs have attracted over $3 billion in net inflows, indicating strong institutional buying.

Total Net Inflows for Bitcoin Spot ETFs

In recent weeks, the strengthening dollar, rising Treasury yields, and the strong performance of the banking and cryptocurrency sectors—these direct “Trump-related stocks”—have shown robust gains. The market is betting real money on the expectation that Trump will win.

Impact of Trump’s Election on Major Asset Prices

As the U.S. election intensifies, expectations for Trump’s victory are growing, prompting the market to bet on the potential impacts of his policies on different asset classes. The economic effects of Trump’s policies could lead to stark differentiation among major assets, altering the global economic landscape.

- Strengthening Dollar

Trump’s policy proposals include raising tariffs and cutting taxes, which are expected to increase inflation expectations. This could make the Federal Reserve more cautious about lowering interest rates, thereby supporting a stronger dollar. Currently, the U.S. economic fundamentals are robust, particularly with high employment rates and moderate inflation, providing strong support for the dollar. It is anticipated that the dollar will continue to strengthen in the global foreign exchange market. - Cyclical and Technology Sectors Likely to Dominate U.S. Stocks

The market is generally optimistic about Trump’s potential boost to U.S. stocks. With a relatively strong U.S. economy, Trump’s emphasis on tax cuts and deregulation is expected to enhance corporate profits and consumer spending. The cyclical and technology sectors are likely to be key focuses for investors. Supported by macro factors such as fiscal expansion, strong demand in the AI sector, and global capital reallocation, the medium to long-term outlook for U.S. stocks appears more attractive.

Historically, U.S. stocks tend to rise in election years. For example, after Trump’s victory in the 2016 election, expansionary policies led to a rapid rebound in the S&P 500, providing a historical reference for this year’s U.S. stock trends.

- Commodity Demand May Face Adjustments

Compared to the Democrats, the Republican energy policy tends to support traditional energy industries. Trump’s election could lead to a relaxation of restrictions on fossil fuels, promoting the expansion of the oil and gas industry, which might suppress oil prices in the medium to long-term. The likelihood of escalating tensions in the Middle East has diminished, and expectations of declining oil demand due to a slowing global economy could lead to short-term fluctuations and weakness in oil prices.

Meanwhile, the gold market has continued to strengthen at high levels, having already incorporated significant safe-haven and anti-inflation demand within the framework of Trump’s policies. This has somewhat diverged from the fundamental support levels based on the dollar and real interest rates. If uncertainty decreases after the election, gold prices may face downward pressure.

- Bitcoin Set for a New Bull Run

The cycle of this year’s U.S. election closely aligns with the cycle of Bitcoin. Trump’s favorable stance toward the crypto market, along with his deep involvement in various crypto activities and related products, has generated excitement, especially his declaration to “make Bitcoin a strategic reserve for the U.S.” A Trump victory would be highly beneficial for the crypto space, leading to a new bull run for Bitcoin, and the influence of crypto assets in the global market is expected to reach new heights.

Conclusion

The current “Trump trade” is profoundly affecting global asset pricing. Regardless of the final outcome of the election, the global market will face an unprecedented opportunity for asset revaluation.

As an official partner of the Argentina national team, eeee.com offers trading services for over 600 assets, including cryptocurrencies, commodities, stocks, and indices. The platform also supports financial products with annualized returns of up to 5.5%, allowing users to invest easily with just a click while holding USDT. Additionally, the 4E platform has a $100 million risk protection fund, adding an extra layer of security for users’ funds. With 4E, investors can stay updated on U.S. election market dynamics, adjust their strategies flexibly, and seize every potential opportunity.

News

UQPAY Becomes a Principal Member of Mastercard for Enhanced Merchant Acquiring

A New Milestone for UQPAY

UQPAY is proud to announce its recent approval as a Principal Member of Mastercard for acquiring business, marking a significant milestone in our journey to enhance digital payment solutions globally. This prestigious status not only underscores UQPAY’s commitment to maintaining the highest standards of service and security in the financial industry, but also positions us at the forefront of payment innovations.

As a Principal Member of Mastercard, UQPAY will now be able to directly acquire merchants and provide them with access to Mastercard’s global payment network. This direct relationship enhances our ability to offer tailored, flexible payment solutions that cater to the diverse needs of businesses in Singapore. Merchants partnering with UQPAY can look forward to a range of benefits that will transform their transaction capabilities and open new opportunities for growth.

Benefits for Merchants

- Enhanced Payment Security: Leveraging Mastercard’s cutting-edge security technologies, UQPAY will offer merchants robust protection against fraud and payment disruptions, ensuring that every transaction is secure.

- Global Reach, Local Service: Through Mastercard’s international network, merchants can effortlessly reach overseas customers while enjoying localized support from UQPAY. This dual advantage is crucial for businesses aiming to grow without borders.

- Customized Payment Solutions: UQPAY’s newfound status as a Principal Member allows for more flexible and innovative payment solutions, tailored to meet the specific needs of our merchants. Whether it’s simplifying mobile payments or integrating multi-currency transactions, UQPAY is equipped to handle it all.

- Streamlined Operations: Merchants will benefit from streamlined operations and reduced processing times, making it easier than ever to manage their finances and improve cash flow.

- Expert Insights and Support: UQPAY’s dedicated team of payment experts is committed to supporting merchants in navigating the complexities of global commerce. Our team will provide insights, advice, and continuous support tailored to help businesses thrive.

A Future of Possibilities

This collaboration between UQPAY and Mastercard represents more than just a business advancement. It signifies a leap towards the future of commerce, where efficiency, security, and customer satisfaction are paramount. We are excited to embark on this journey, enhancing the payment experiences of our merchants and their customers around the globe.

For current and prospective merchants, this development means access to a world-class payment infrastructure backed by the trust and reliability of Mastercard. We invite businesses of all sizes to join us in reaping the benefits of this new era of payment solutions.

Stay connected with UQPAY as we continue to innovate and lead in the delivery of premier digital payment solutions. Together, we are setting new standards in the world of transactions, paving the way for a seamless, secure, and prosperous future for all our partners.

ABOUT UQPAY:

Grow Your Business Borderlessly

UQPAY is a one-stop global digital payment solution provider headquartered in Singapore, with branches in multiple locations worldwide. Since 2017, UQPAY has been delivering seamlessly integrated, one-stop solutions designed for global application, adhering to the highest industry standards for security. UQPAY holds several financial licenses, including the Major Payment Institution (MPI) License issued by the Monetary Authority of Singapore (MAS) and the Money Services Business (MSB) license in the United States. Additionally, UQPAY is a member of the Singapore FinTech Association and has been recognized as one of Singapore’s Top 500 Most Successful SMEs.

Contact UQPAY

UQPAY Website: https://uqpay.com/

UQPAY Twitter: https://x.com/UQPAYSG

UQPAY PTE. LTD.

9 North Buona Vista Drive, #02-01, Metropolis Tower 1, Singapore 138588

Phone: +65 8328 0868

Email: bd@uqpay.com

-

Fashion9 years ago

Fashion9 years agoThese ’90s fashion trends are making a comeback in 2017

-

Entertainment9 years ago

Entertainment9 years agoThe final 6 ‘Game of Thrones’ episodes might feel like a full season

-

Business9 years ago

Business9 years agoThe 9 worst mistakes you can ever make at work

-

Fashion9 years ago

Fashion9 years agoAccording to Dior Couture, this taboo fashion accessory is back

-

Business9 years ago

Business9 years agoUber and Lyft are finally available in all of New York State

-

General2 years ago

General2 years agoCowordl: A Collaborative Twist on the Word Puzzle Craze

-

Entertainment9 years ago

Entertainment9 years agoThe old and New Edition cast comes together to perform

-

Entertainment9 years ago

Entertainment9 years agoDisney’s live-action Aladdin finally finds its stars